Corporate Governance

- Home

- IR

- Management Policy and Growth Strategy

- Corporate Governance

Basic Concept

The S-Pool Group's basic concept on business activities calls for fulfilling our mission, defined as the contributions the Group must make to society. To realize this mission, the Group has a basic policy of corporate governance emphasizing the need to improve management efficiency and transparency. The Group pursues ethical corporate behavior to increase society's trust not just in the Group itself, but in the broader industry. It does so through thoroughgoing compliance with laws and regulations and by developing and enhancing internal control systems. To realize our mission, we have set out more specific visions in the Medium-term Management Plan and also established the S-Pool Values, a shared code of conduct for employees.

Mission

The Group's mission is articulated as follows: Applying the power of outsourcing to support corporate innovation and solutions to society's challenges. In line with this mission, we seek to realize, through our business activities, solutions to various social issues and the associated corporate issues. By pursuing our social businesses, we seek both to create new social value and to play an essential role in society.

Reasons for Not Implementing the Principles of the Corporate Governance Code

[Principle 2-4 ①: Securing Diversity in Appointment of Core Human Resources, etc.]

To ensure a fair employment screening process, the Group does not discriminate against applicants on the grounds of race, nationality, gender, sexual orientation, etc. and promotes hiring and employment of diverse employees based solely on applicant ability and aptitude.

Our human resource development policies and efforts, which seek to secure this diversity, as well as our policies for improving related internal environments, are disclosed on our website and elsewhere.

Regarding the promotion of women to managerial positions, we have set a specific target figure for the ratio of women workers in managerial positions as a measurable parameter. We disclose this figure in our securities reports.

We have not set targets for the promotion of mid-career hires to managerial positions, but we maintain a fixed percentage of mid-career hires among the Group’s employees. We believe we are making solid progress in promoting mid-career hires to managerial positions.

As of now, due to the relatively low numbers of non-Japanese employees, we have set no specific targets or other goals regarding the promotion of non-Japanese workers to managerial positions. Promotion to managerial positions requires consideration of employee aptitude and ability on a case-by-case basis.

[Principle 4-1 ③: Succession Plan for Chief Executive Officer (CEO)]

At this point in time, the Company has not established a clear succession plan for the Chief

Executive Officer. We expect to select a successor drawn from internal and external candidates

deemed appropriate in light of personal characteristics, expertise, track record and other

considerations.

As with the succession plan, we have not yet established a system for guiding the succession

process.

[Supplementary Principle 4-10 ①: Optional Nomination and Remuneration Committees]

The Company’s organization is that of a company with a board of statutory auditors (kansayaku). Independent External Directors do not constitute a majority of the Board of Directors. No independent advisory boards such as optional nomination and remuneration committees have been established to enhance the independence, objectivity and accountability of the functions of the Board of Directors in aspects such as the nomination of candidate Directors and remuneration of Directors.

This is because the current Board of Directors is deemed sufficiently independent, objective and accountable. Three of the six Directors are External Directors, while all three Statutory Auditors are External Statutory Auditors. External officers account for a majority of the attendees at meetings of the Board of Directors. Lively debate takes place in deliberations of matters such as nomination and remuneration.

Each period, in addition to the nomination of candidate Directors, individual remuneration for Executive Directors is discussed with External Directors and Statutory Auditors and their approval obtained.

[Principle 4-11: Preconditions for Board of Directors and Board of Statutory Auditors Effectiveness]

The Company Board of Directors features a diverse membership of Directors with different areas of

expertise, experience and other backgrounds and in terms such as their gender, job history, and

age to ensure that the Board of Directors effectively fulfills its roles and responsibilities. In

accordance with the articles of incorporation, appropriate numbers of members are maintained to

enable the Board of Directors to exercise its functions most effectively and efficiently from the

following perspectives:

i) Securing adequate diversity for management decision-making and oversight

ii) Stimulating debate within the Board of Directors, centered on the Independent External Directors

To apply the wealth of external experience and expertise in Company management, enhance the

oversight functions of the Board of Directors and increase management transparency, at least one

third of the Directors are Independent External Directors. The Company has one Independent External

Director who is a woman and one woman Statutory Auditor.

In addition, while the Company has not appointed External Statutory Auditors with expert knowledge

of financial and accounting topics, we believe the financial and accounting information needed by

the Board of Statutory Auditors to fulfill its roles can be obtained through cooperation with

External Statutory Auditors and External Directors who are certified public accountants.

Each fiscal year, to assess the overall efficacy of the Board of Directors, we undertake anonymous

surveys on topics such as the composition of the Board of Directors, the way in which it operates,

the nature and quality of deliberations by the Board, the monitoring functionality of the Board

and the performance of External Directors. The results are duly analyzed and evaluated.

To ensure this survey reflects the frank opinions of respondents and to ensure that such opinions

are analyzed and evaluated objectively, the results are gathered and compiled by an independent

institution.

We will continue to assess the efficiency of the Board of Directors as a whole and to use the

results thereof to improve the operations of the Board.

![]() Report on Corporate Governance (February 28, 2025) (PDF_910KB)

Report on Corporate Governance (February 28, 2025) (PDF_910KB)

- ▼Corporate Governance Structure

- ▼Matters Related to Internal Control Systems, etc.

- ▼Dialogue with Shareholders and Investors

- ▼Compliance

Corporate Governance Structure

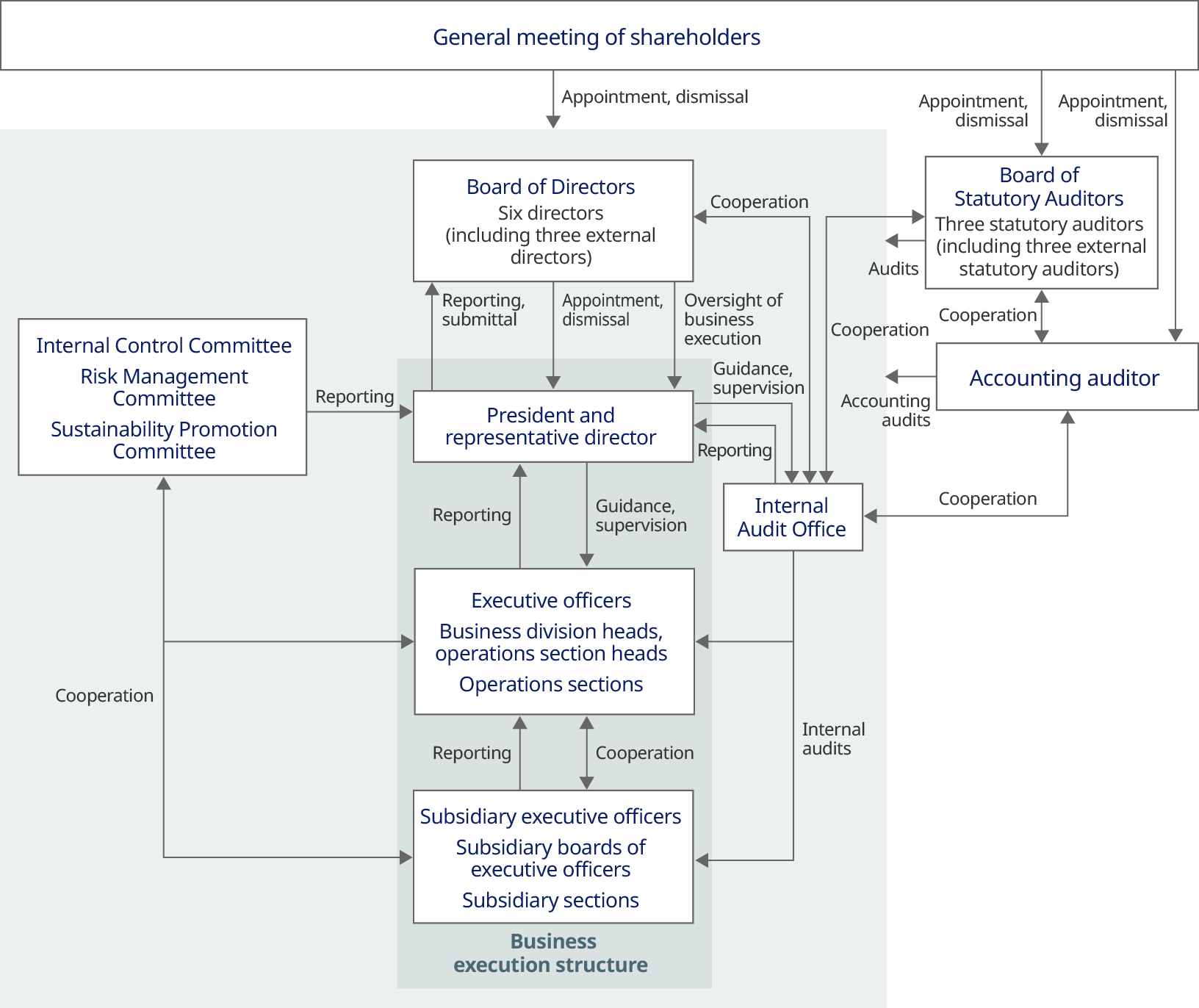

Officers and Business Execution Structure

As management bodies, the Company has established a Board of Directors centered on External Directors and has adopted a system of Statutory Auditors (kansayaku) that it considers capable of demonstrating effective management oversight functions in light of the Company's size.

The Company Board of Directors consists of six Directors. Its roles include making decisions on Group management policies, management strategies, business plans, acquisition and disposal of important properties, and important organizational and personnel matters, and overseeing the business execution of the Company and subsidiaries. The Board of Statutory Auditors consists of three Statutory Auditors, whose roles are to establish audit policies and plans through deliberations of the Board of Statutory Auditors and to audit the execution of the duties of Directors through attendance in regular and extraordinary meetings of the Board of Directors and in other internal meetings as necessary, as well as auditing the state of business and property at the head office, other business facilities, and subsidiaries. In addition, all external officers have been reported to the Tokyo Stock Exchange as independent officers, and efforts are being made to strengthen governance through operation of a Board of Directors and a Board of Statutory Auditors in which independent officers play a central role.

At the Company, Executive Directors, executive officers, division heads and operations section heads execute business based on business plans formulated by the Board of Directors. The Board of Directors meets monthly, in principle, as well as meeting as needed, to carry out management decision-making and oversight and management of business execution by Directors through review of reports of business results. In addition, to enhance the functions of the Board of Directors and improve management efficiency, the Representative Director holds a monthly Group Management Conference with members including Executive Directors, business division heads, and subsidiary presidents, to share management information and to efficiently deliberate on matters related to business execution.

Accounting Auditor

Through comprehensive consideration of matters such as the availability of a structure capable of centralized audits of Group business activities, in addition to perspectives such as the presence of a quality control system, independence and expertise and continuity and efficiency of auditing, the Company has chosen Grant Thornton Taiyo LLC as an auditing firm, to which it entrusts account auditing operations. It has employed this auditing firm for 17 years.

The names of certified public accountants employed in account audits for the period ended November 2024 and the composition of assistants involved in auditing, are shown below.

Certified public accountants employed in account auditing: Designated limited liability employee / business execution employee Yoichi Honma, Hiroyuki Imai

Composition of assistants involved in audits: 6 certified public accountants and 13 other assistants.

Independence of External Directors

None of the External Directors or External Statutory Auditors has a background with a parent company

or other affiliate or is a major shareholder in the Company. In addition, none of the External

Directors or External Statutory Auditors is a spouse, relative within three degrees of

consanguinity, or equivalent party of an executive director, executive officer, etc. of the Company

or specific affiliated business of the Company. None receives executive compensation or other

financial gains from Company subsidiaries. Accordingly, both External Directors and External

Statutory Auditors are deemed sufficiently independent from the Company.

While the Company has not established specific standards or policies concerning independence in its

appointment of External Directors and External Statutory Auditors, their appointment is based on

individual judgment of matters such as their freedom from specific interests in the Company, such as

personal or capital ties, and their ability to oversee Group management based on a high degree of

knowledge, with reference to the standards for independence established by the Tokyo Stock Exchange.

Reasons for Appointment of External Directors and External Statutory Auditors

External Director (independent officer)

Toru Akaura

Mr. Akaura is a General Partner of Incubate Capital Partners, an operating

partner of the investment partnership Incubate Capital Partners, which formerly was a major

shareholder in the Company.

<Attendance at Board of Directors Meetings in FY2024>

14 / 14(100%)

His appointment is intended to help strengthen and enhance corporate governance through securing further improvements in the efficiency and transparency of Company management.

While he has served as an officer of other companies in the past and currently serves concurrently as an officer of other companies, we have no particular mutual interest nor conflicts of interest with such companies.

There is also no particular mutual interest nor conflicts of interest between Mr. Akaura and the Group, and his appointment is thought to present no particular problems with regard to the independence of External Directors from the standpoint of protection of general shareholders.

Director Akaura has been appointed by the Board of Directors as an independent officer. This is based on the judgment that he is suitable in light of the purposes of independent officers, based on his independence and expertise concerning corporate investment, as described above.

External Director (independent officer)

Nao Miyazawa

<Attendance at Board of Directors Meetings in FY2024>

14 / 14(100%)

Her appointment is intended to help strengthen and enhance corporate governance through securing further improvements in the efficiency and transparency of Company management.

There is also no particular mutual interest nor conflicts of interest between Ms. Miyazawa and the Group, and her appointment is thought to present no particular problems with regard to the independence of External Directors from the standpoint of protection of general shareholders.

Director Miyazawa has been appointed by the Board of Directors as an independent officer. This is based on the judgment that she is suitable in light of the purposes of independent officers, based on her independence and high degree of legal knowledge as an attorney, as described above.

External Director (independent officer)

Kazuhiko Nakai

<Attendance at Board of Directors Meetings in FY2024>

14 / 14(100%)

His appointment is intended to help strengthen and enhance corporate governance through securing further improvements in the efficiency and transparency of Company management.

There is also no particular mutual interest nor conflicts of interest between Mr. Nakai and the Group, and his appointment is thought to present no particular problems with regard to the independence of External Directors from the standpoint of protection of general shareholders.

Director Nakai has been appointed by the Board of Directors as an independent officer. This is based on the judgment that he is suitable in light of the purposes of independent officers, based on his independence and high degree of knowledge concerning finance and accounting as a certified public accountant, as described above.

External Statutory Auditor (independent officer)

Xu Jin

<Attendance at Board of Directors Meetings in FY2024>

Board of Directors: 14 / 14(100%)

Board of Statutory Auditors: 13 / 13(100%)

While she has served as an officer of other companies in the past and currently serves concurrently as an officer of other companies, we have no mutual interest nor conflicts of interest with such companies.

There is also no particular mutual interest nor conflicts of interest between Ms. Xu and the Group, and her appointment is thought to present no particular problems with regard to the independence of External Statutory Auditors from the standpoint of protection of general shareholders.

Statutory Auditor Xu has been appointed by the Board of Directors as an independent officer. This is based on the judgment that she is suitable in light of the purposes of independent officers, based on her independence and efforts to strengthen Group governance as Standing Statutory Auditor, as described above.

External Statutory Auditor (independent officer)

Hiroshi Hatanaka

<Attendance at Board of Directors Meetings in FY2024>

Board of Directors: 14 / 14(100%)

Board of Statutory Auditors: 11 / 13(85%)

While he currently serves concurrently as an officer of other companies, we have no particular mutual interest nor conflicts of interest with such companies.

There is also no particular mutual interest nor conflicts of interest between Mr. Hatanaka and the Group, and his appointment is thought to present no particular problems with regard to the independence of External Statutory Auditors from the standpoint of protection of general shareholders.

Statutory Auditor Hatanaka has been appointed by the Board of Directors as an independent officer. This is based on the judgment that he is suitable in light of the purposes of independent officers, based on his independence and expertise in management in general as a management consultant and manager with other companies, as described above.

External Statutory Auditor (independent officer)

Noboru Yamashita

<Attendance at Board of Directors Meetings in FY2024>

Board of Directors: 9 / 9(100%)

Board of Statutory Auditors: 10 / 10(100%)

While he has not been involved in corporate management other than having served in the past as an external director and external auditor, it was judged that he possesses extensive specialized knowledge related to labor as a labor and social security attorney and that he would be able to utilize this knowledge in auditing at the Company.

There are no particular mutual interests or conflicts of interests between Mr. Yamashita and the Group and no particular problems with regard to his independence as an External Auditor from the standpoint of protecting general shareholders.

Statutory Auditor Yamashita has been appointed by the Company as an independent officer on the Board of Directors.

As stated as above, this is because he is independent, possesses extensive knowledge related to personnel and labor as a labor and social security attorney, and so has been judged to be suitable in light of the purposes of independent officers.

Skills Matrix

| Specialization and experience | ||||||||

|---|---|---|---|---|---|---|---|---|

| Gender | Corporate management | Business development, M&A |

Finance, accounting | CSV ESG | HR development | Compliance, risk management | ||

| Directors | Sohei Urakami Representative Director |

Male | ○ | ○ | ○ | |||

| Hideaki Sato Director |

Male | ○ | ○ | ○ | ||||

| Naoshi Arai Director |

Male | ○ | ○ | ○ | ||||

| Toru Akaura External Director |

Male | ○ | ○ | |||||

| Nao Miyazawa External Director |

Female | ○ | ||||||

| Kazuhiko Nakai External Director |

Male | ○ | ||||||

| Statutory Auditor | Xu Jin Standing Statutory Auditor |

Female | ○ | ○ | ||||

| Hiroshi Hatanaka External Statutory Auditors |

Male | ○ | ○ | ○ | ||||

| Noboru Yamashita External Statutory Auditors |

Male | ○ | ○ | |||||

* This table does not show all skills possessed by each director and statutory auditor.

Remuneration of Directors and Statutory Auditors

| Annual total remuneration of Directors | 106 million yen (including remuneration of External Directors of 10 million yen) |

|---|---|

| Annual total remuneration of Statutory Auditors | 19 million yen (including total remuneration for External Statutory Auditors of 19 million yen) |

The maximum limit on annual remuneration for Directors under a resolution of the February 27, 2018

general meeting of shareholders is 200 million yen (including up to 30 million yen per year for

the remuneration of External Directors). Remuneration amounts are determined in consideration of

the posts and duties of each Director within this maximum limit.

Remuneration of Executive Directors consists of fixed remuneration and performance-linked bonuses.

In addition, the work-linked bonus for representative directors incorporates social and environmental

items as non-financial indicators and is linked to short- and long-term compensation programs.

Amounts of which are calculated through methods specified in internal rules. In consideration of the

nature of their posts, remuneration for non-executive Directors and Statutory Auditors, whose

positions are independent from business execution, is paid in the form of fixed remuneration only.

Amounts of fixed remuneration for Executive Directors are proposed for each individual by the

Representative Director in a regular meeting of the Board of Directors held after the annual

settlement of accounts has been finalized, reflecting matters such as the duties, abilities,

experience, and years of service of each Director in addition to his or her performance in the

previous period, including increases or decreases in corporate value, measures implemented regarding

returns to shareholders, growth in sales and profit, development of new businesses, and progress of

human resource development and organizational development. Final decisions are made through

deliberation on the proposed remuneration amounts among parties including non-executive Directors

and Statutory Auditors.

Matters Related to Internal Control Systems, etc.

Considering the main purposes of internal controls to be maintaining legal and regulatory compliance, improving business efficiency, and ensuring the reliability of financial reports, the Company strives to establish effective internal control systems through appropriate planning, development, operation, monitoring, and audits.

1. Overview of the state of operation during this business year

Compliance initiatives

The Company President and Representative Director issues periodic messages on the importance of compliance to Company and subsidiary Directors and employees. Internal training is provided on information security, prevention of insider trading, and other topics, as part of continuous efforts to raise awareness on compliance.

Risk management initiatives

The Board of Directors ascertains and evaluates risks Groupwide and considers responses to risks

with impacts across the organization. In addition, monthly Group Management Conferences in which the

External Directors and Standing Statutory Auditor take part include information sharing and

deliberation on the state of management of risks accompanying the businesses of individual sections

and subsidiaries.

During the fiscal period ended November 2024, the Board of Directors and Group Management Conferences

played central roles in managing the risk generation status and the status of implementing preventive

measures for risks the Company has consistently deemed of utmost importance: those involving legal

amendments or strengthened regulations with the potential to impact the business environment;

labor issues, such as industrial accidents and long working hours, leakage of personal information

and industry-specific issues that may impact management strategies, such as changes in economic or market conditions,

as well as the potential impact of events involving competitors, including mergers and acquisitions or decisions to

open competing facilities.

In addition, the Group is working actively to strengthen productivity through IT investments and

other initiatives. We have raised the importance score of the risk of failing to achieve the

purpose of introducing IT systems due to inadequate prior consideration regarding their

introduction and are carefully ascertaining current conditions and managing progress.

Efforts to ensure the propriety and efficiency of the performance of duties of Directors

The Company Board of Directors consists of six Directors, including three External Directors. The

three External Statutory Auditors also attend Board meetings. During the fiscal period ended

November 2024, the Board of Directors met 14 times and implemented timely decision-making while

paying close attention to lawful and appropriate operations. Matters related to risk management

and business execution were deliberated on, in addition to confirmation and analysis of and

development of appropriate strategies for the state of progress in businesses and performance of

each section and subsidiary. The Board of Directors also monitored the state of performance of

the duties of Directors of the Company and subsidiaries.

Materials for deliberation by the Board of Directors are distributed in advance to enable attendees

to prepare adequately. Directors and Statutory Auditors actively exchange opinions at the

deliberations.

Matters involving important management decision-making at subsidiaries are resolved at the

Company’s Board of Directors meetings.

Systems for reporting by Directors and employees to Statutory Auditors, and other systems related to reporting to Statutory Auditors

An internal whistleblowing system (compliance hotline) has been established as a reporting system for the entire Group, with non-standing External Statutory Auditors serving as contact points. In addition, efforts are being made to raise awareness among all Group employees through the Group intranet.

Performance of the duties of Statutory Auditors

Based on audit plans, the Standing Statutory Auditor attends Group Management Conferences and important meetings of subsidiaries to confirm appropriate business execution and shares information in meetings of the Board of Statutory Auditors, which met 13 times during the fiscal period ended November 2024. In addition, business auditing is conducted in cooperation with the Internal Audit Office, ascertaining information on a wide range of risks through interviews with officers and employees. Meetings also are held with the accounting auditor, both periodically and at other times as needed, to ascertain the propriety of financial accounting.

2. Basic concept on exclusion of antisocial forces and state of these efforts

Basic concept on exclusion of antisocial forces

The Company's basic policy is to refuse any and all relations to antisocial forces and to respond resolutely, as an organization, to any improper demands or inducements.

State of efforts to exclude antisocial forces

The Company's General Affairs Department is tasked with coordinating response to antisocial forces. Since December 2003, we have been a member of Tokubouren, an association under the Metropolitan Police Department that seeks to prevent specified acts of violence. In addition to striving to collect information through attending its regular meetings and other events, we seek its guidance as needed.

Dialogue with Shareholders and Investors

1. State of initiatives to stimulate participation in the general meeting of shareholders and facilitate the exercise of voting rights

Issuing notices of convening general meetings of shareholders early

In principle, to allow sufficient time for full consideration of meeting resolutions while ensuring

the accuracy of the content of the notices, we send out notices of convening general meetings of

shareholders by one day before the legal deadline.

We also announce convocations of general meetings of shareholders on our website and that of the

Tokyo Stock Exchange before sending out notices of convening the meetings to ensure shareholders

have enough time to consider the resolutions fully.

Scheduling general meetings of shareholders to avoid dates when there are large numbers of such meetings held

We avoid holding general meetings of shareholders on dates on which large numbers of such meetings are held by ending our fiscal period on November 30. We intend to continue to focus on stimulating participation in general meetings of shareholders. We hold briefings on topics such as the Company's lines of business and future strategies after the general meetings of shareholders to expand shareholder participation.

Exercise of voting rights through electromagnetic means

We have adopted exercise of voting rights through an electromagnetic method.

Participation in a platform for electronic exercise of voting rights and other initiatives to facilitate exercise of voting rights by institutional investors

We participate in a platform for electronic exercise of voting rights operated by ICJ, Inc.

2. State of IR activities

Holding periodic briefings for individual investors

Briefings are held several times a year for individual investors. In addition, videos of the briefings are streamed from the IR website for investors unable to attend in person.

Holding periodic briefings for analysts and institutional investors

Upon the settlement of accounts each year, the Chairman of the Board, President and Representative Director of the Company holds a briefing on the settlement of accounts and business strategies. A similar briefing is held in the second quarter.

Posting IR materials on the website

IR information is disclosed at www.spool.co.jp/investor/. Information on the settlement of accounts and timely disclosure materials, briefing materials, and FAQs are made available.

Establishing an IR section (person in charge)

The President's Office is in charge of IR.