Climate Change (TCFD)

- Home

- Sustainability

- Environment

- Climate Change (TCFD)

Climate change initiatives

Disclosure based on TCFD recommendations

In February 2022 the Group announced its support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In addition to enhancing governance, we strive to improve the quality and quantity of disclosure based on an analysis of the risks and opportunities that climate change presents to Group businesses.

Governance

We have developed a governance structure centered on oversight by the Board of Directors and management by the Sustainability Promotion Committee to promote basic policies and priority topics concerning environmental issues as a whole, including climate change, in accordance with our Environmental Policy.

Climate change management structure

Chaired by the director in charge of President's Office, the Sustainability Promotion Committee's membership consists of Group company operating officers and other executives. The Committee meets semiannually to discuss risks and opportunities related to climate change, and submitted or reported to the Board, which oversees the company's activities.

Introduction of executive compensation linked to achievement of environmental indicators

In light of the importance of global climate change and other environmental issues, the compensation of the Chairman and CEO is set to be linked to the evaluation of the achievement of key environment-related indicators (progress in reducing greenhouse gas emissions and percentage of renewable energy use). The CEO proactively monitors progress toward the renewable energy adoption strategy and climate change targets, thereby encouraging the achievement of non-financial KPIs for the entire company.

Strategy

Scenario analysis

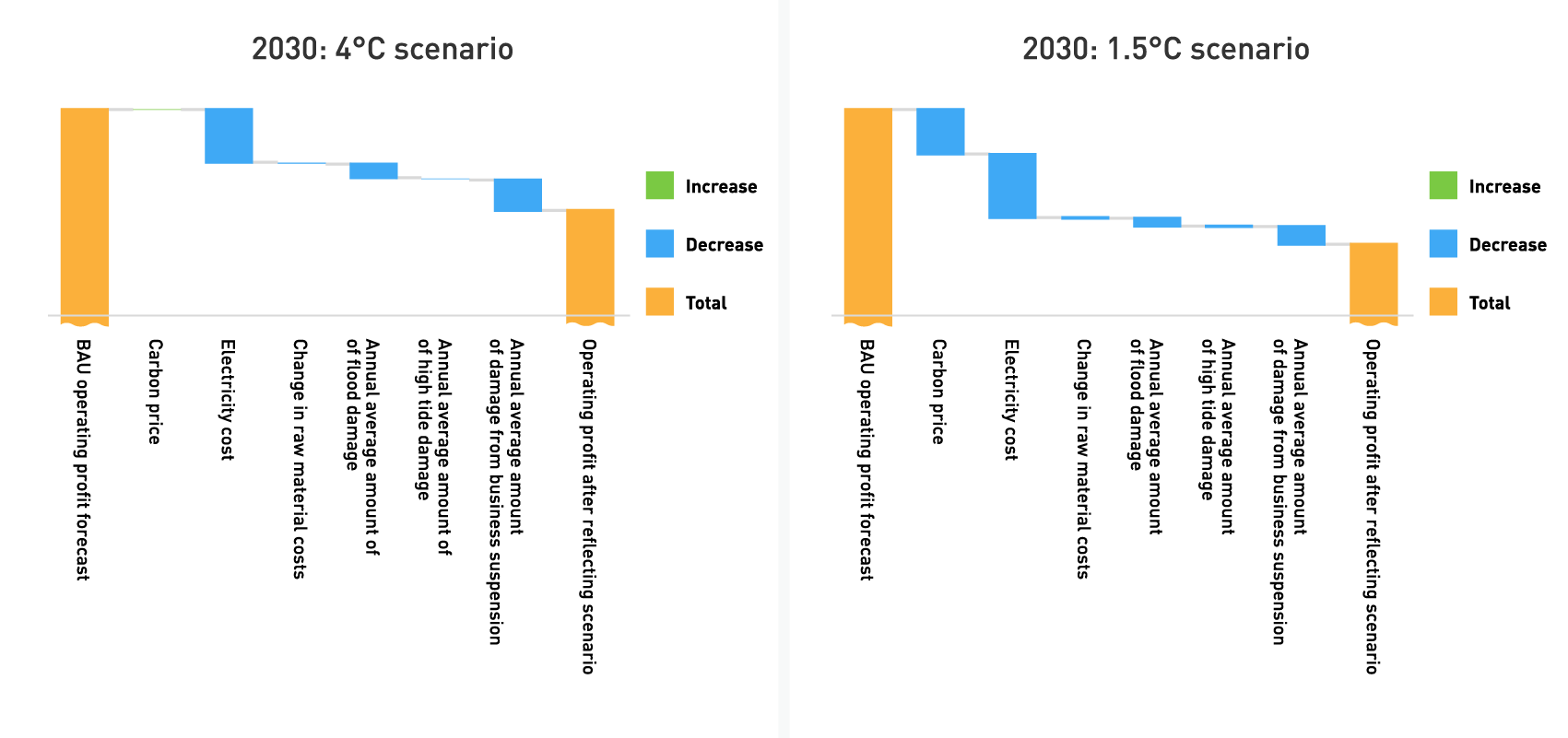

In implementing scenario analysis, the Group

identifies major risks and opportunities related to

climate change and assesses specific monetary amounts

of their financial impacts in the Sustainability

Promotion Committee.

We formulated two scenarios to consider impacts in

2030 centered on two business areas we consider

especially susceptible to climate change: the Special

Needs Employment Support Business (S-Pool Plus, Inc.)

and the Logistics Outsourcing Business (S-Pool

Logistics, Inc.). These scenarios assume either

success in achieving carbon neutrality by 2050 or

increasingly severe global warming.

-

1.5℃ scenarioA scenario in which the global transition to decarbonization progresses at a level that achieves carbon neutrality by 2050, with changes in policy regulations and market trends forecasted to occur as a result of the transition.Reference Scenario

IEA WEO2021 – SDS / APS / NZE2050

IPCC AR5 - RCP2.6 -

4℃ scenarioA scenario in which the transition to decarbonization is not undertaken beyond current levels, and global warming is assumed to become more severe, with more extreme weather events and associated adaptation needs being forecasted.Reference Scenario

IEA WEO2021 – STEPS

IPCC AR5 – RCP8.5

Business impact assessment

In assessing the scale of impacts through use of quantitative business impact estimates, we regard a financial impact of 100 million yen or more as a severe impact. Qualitative impacts assume the same definition. The aspects estimated are shown below. For physical risks (extent of damage due to flooding or high tides, extent of damage due to suspended operations), we averaged annual expected damages, based on the relative evaluation, by taking into account the probability of occurrence of disasters.

| Item | Impact | Evaluation ※1 | |||||

|---|---|---|---|---|---|---|---|

| Category | Subcategory | Sub-subcategory | Time axis ※2 | Indictor | Considerations | 4℃ | 1.5℃ |

| Migration risks | Policy/regulatory | Carbon pricing | Medium term | Expenditures |

[Groupwide]

Rising costs related to electricity, fuel

use, etc. at logistics facilities, farms,

and other business sites due to carbon

pricing

|

Low | Medium |

| Responding to GHG emissions restrictions |

Medium term - long term |

Expenditures Assets |

[Groupwide]

Rising costs associated with measures to

improve the environmental performance of

logistics facilities, farms, and other

facilities to meet more rigorous GHG

reduction requirements

|

Low | High | ||

| Plastic restrictions | Medium term | Expenditures |

[S-Pool Logistics, Inc.]

Cost of responding to regulations governing

use of plastic and other packing materials

|

Low | Medium | ||

| Markets | Changing energy costs |

Short term - Medium term |

Expenditures |

[Groupwide]

Higher selling expenses due to the rising

cost of the fuel used in temperature

controls

|

Medium | Medium | |

| Changing customer behavior |

Short term - Medium term |

Revenues |

[Groupwide]

As environmental awareness grows among

clients, risk of declining revenue due to

inability to shift to services and products

with lower environmental impact

|

Low | High | ||

| Reputation | Changing reputation among investors |

Medium term - long term |

Revenues Expenditures |

[Groupwide]

Falling stock prices or rising fundraising

costs if investors determine our initiatives

are inadequate based on their growing

interest in environmental initiatives

|

Medium | High | |

| Physical risks | Acute | Intensifying abnormal weather events |

Short term - long term |

Revenues Expenditures Assets |

[Groupwide]

Weather-related damage leading to the

suspension of operations at farms, logistics

facilities, etc.; reduced earnings due to

suspended operations at client facilities

|

High | Medium |

| Chronic | Worsening working and construction conditions |

Short term - long term |

Revenues Expenditures |

[S-Pool Plus, Inc.]

Lower productivity or higher hiring costs

due to fewer applicants as rising

temperatures lead to worsening working

environments inside greenhouses

|

High | Medium | |

| Opportunities | Energy source | Use of renewable energy |

Short term - Medium term |

Revenues |

[S-Pool Logistics, Inc.]

Sales growth achieved by providing

differentiated services using renewable

energy

|

Low | Medium |

| Products/Services | Decarbonization services |

Short term - Medium term |

Revenues |

[S-Pool Logistics, Inc.]

Sales growth achieved by using non-plastic

packing materials in response to growing

demand for ethical consumption

|

Low | Medium | |

| Disclosure |

Short term - Medium term |

Revenues |

[S-Pool Blue Dot Green Inc. / S-Pool,

Inc.]

Greater demand for disclosure consulting

services to meet corporate disclosure

obligations

|

Low | High | ||

| Market | emissions trading |

Short term - Medium term |

Revenues |

[S-Pool Blue Dot Green Inc. / S-Pool,

Inc.]

Sales growth for emissions trading brokerage

services

|

Low | High | |

| Resilience | Adapting abnormal weather events |

Short term - Medium term |

Revenues |

[S-Pool Plus, Inc.]

Providing services in urban areas based on

indoor farms, which are less susceptible to

climate change risks

|

Medium | Low | |

※1 Time horizon: Short-term = 1 to 3 years

Medium-term = 3 to 10 years Long-term = 10 years and

up

※2 Financial Impact Assessment: Large=More than 100

million yen, Medium=Less than 100 million yen,

Small=Minor or no impact

Migration risks: Risks generated from reassessment

of the financial value of assets with high levels of

GHG emissions, accompanied with migration to

low-carbon economy

Physical risks: Direct impact such as property

damage caused by flooding, heavy wind and rain, and

other weather conditions; indirect impact such as

global supply chain disruptions and resource

depletion

Thinking of financial impact (small, medium, large):

Relative impacts assessed through quantitative and

qualitative analysis

4℃ scenario: A scenario under which global

mean temperatures by the end of this century are

about 4℃ higher than before the industrial

revolution due to the lack of progress on measures

to counter climate change. While this scenario poses

high physical risks, including intensification of

abnormal weather events and rising sea levels, it

also assumes no additional restrictions on corporate

and consumer behavior from current levels.

1.5℃ scenario: A scenario under which global

mean temperatures by the end of this century are

about 1.5℃ higher than before the industrial

revolution due to active initiatives toward

achieving carbon neutrality. While this scenario

envisions a controlled increase in physical risks,

it also assumes stronger restrictions on corporate

and consumer behavior through means such as taxation

policies, laws, and regulations.

In assessing the scale of impact, based in part on the results of the quantitative business impact estimates, a significant impact is defined as one that has a financial impact of at least 100 million yen, and qualitative impacts are also assessed based on the same definition. The following chart shows the items that have been estimated. For physical risks (flood and storm surge damage and business interruption damage), the probability of a disaster occurring is taken into account, and the estimated damage is averaged out to an annual average for the relative assessment.

In terms of company-wide impact, with regard to physical risks, we expect damage due to wind and water disasters such as flooding. In particular, losses due to business shutdowns during the disaster, mainly at farms and distribution centers, are expected to put pressure on finances. The impact of the transition to decarbonization will be additional expenditure and higher energy costs due to the introduction of carbon pricing schemes. In particular, it is assumed that the increase in expenditure on electricity, the main energy source throughout the Group, will result from higher air-conditioning use due to rising temperatures and higher electricity prices as a result of the switch to renewable energy generation. On the other hand, various decarbonization measures are being considered by industry and public authorities to decarbonize, and it is expected that the application of these measures to administrative services and information disclosure by companies will increase, but demand for the decarbonization support services for municipalities that the Company provides and the environmental management support services provided by S Pool Blue Dot Green is expected to increase. Other impacts identified by business segment are as follows.

-

Special Needs Employment Services

Under the 4℃ scenario, the business is expected to suffer chronic impacts on farm operations, including worsening labor conditions, such as increased risk of heat stroke due to rising temperatures, and shutdowns due to difficulties in controlling temperatures related to crop growth. In contrast, the 2℃ scenario confirms that while operating costs are expected to increase due to the development of tax systems for decarbonization and higher energy prices, there are opportunities for increased sales and increased corporate value through the development of services that respond to changes in customer behavior and reputational awareness. -

Logistics Outsourcing Services

For the 4℃ scenario, we reaffirmed the high physical risk of damage to Company logistics facilities and infrastructure due to intensifying abnormal weather events, resulting in the interruption of operations and rising costs of countermeasures and damages. Nevertheless, we also confirmed the possibility that this business could contribute to society by changing customer behavior in ways that increase use of e-commerce services and through systemic enhancements such as strengthening business continuity planning (BCP) measures. Other outcomes under the 2℃ scenario include the possibility of higher operating costs due to carbon pricing for decarbonization and opportunities for growth in corporate value by improving the environmental performance of packing materials, fixtures, and equipment.

The results of these analyses and deliberations will be enhanced resilience for future uncertainties by incorporating the results of deliberations in management strategies.

Specific Strategies and Initiatives

Based on the risks and opportunities identified in the scenario analysis above, the Group has begun to integrate the following strategies.

-

We contribute to solving environmental challenges by actively developing our business in the environmental area: from 2023, we will start providing decarbonization transition support services for municipalities, helping them to calculate and reduce their GHG emissions, thereby facilitating the realization of zero-carbon cities. In addition, by looking ahead to the trend towards 'mandatory' CO₂ reductions, we are working towards establishing new CO₂ reduction program services and building a new revenue pillar in the environmental sector. In our own initiative, we are promoting reduction initiatives by calculating emissions on a group-wide basis.

We contribute to solving environmental challenges by actively developing our business in the environmental area: from 2023, we will start providing decarbonization transition support services for municipalities, helping them to calculate and reduce their GHG emissions, thereby facilitating the realization of zero-carbon cities. In addition, by looking ahead to the trend towards 'mandatory' CO₂ reductions, we are working towards establishing new CO₂ reduction program services and building a new revenue pillar in the environmental sector. In our own initiative, we are promoting reduction initiatives by calculating emissions on a group-wide basis. -

At Work Happiness Farms, in the face of weather anomalies exacerbated by climate change, we are considering countermeasures to fierce heatwaves and large-scale typhoons. To counter heatwaves, we are making continual environmental improvements, including modifying layouts to set up shaded spaces.

At Work Happiness Farms, in the face of weather anomalies exacerbated by climate change, we are considering countermeasures to fierce heatwaves and large-scale typhoons. To counter heatwaves, we are making continual environmental improvements, including modifying layouts to set up shaded spaces.

We are countering typhoons by installing windbreak fences that reduce damage, especially at farms that have suffered severe wind damage in the past. To realize further stability improvements in farm operations, we have opened indoor farms less exposed to the risks of climate change. We plan to establish a sustainable business structure through ongoing response to weather anomalies and by steadily opening additional indoor farms. -

S-Pool Logistics, Inc. is advancing environmental management for net zero CO2 emissions to mitigate climate change. As part of our efforts to reduce our own environmental impact through voluntary environmentally friendly initiatives, we have participated in the 'RE Action 100 Renewable Energy Declaration' since 2020, and have introduced renewable energy at our main sites using FIT non-fossil certificates from 2023. We're cutting CO2 emissions by steadily switching to renewable energy sources and reducing labor needs through automation. As a new initiative, we plan to open an eco-friendly zero-emissions warehouse to help realize carbon neutrality. This is intended to achieve the goal of zero CO2 emissions. At the same time, seeing the expanding movement toward CO2 reductions as an opportunity, we're working to secure new customers among companies promoting their own climate change initiatives. We're striving to develop structures for sustained business operations through investments with an eye toward progress in automation technologies. We will seek to minimize the impact of events such as disruptions in logistics networks resulting from natural disasters by securing employee safety, assuring cargo security, and sharing information on delivery conditions with our customers.

S-Pool Logistics, Inc. is advancing environmental management for net zero CO2 emissions to mitigate climate change. As part of our efforts to reduce our own environmental impact through voluntary environmentally friendly initiatives, we have participated in the 'RE Action 100 Renewable Energy Declaration' since 2020, and have introduced renewable energy at our main sites using FIT non-fossil certificates from 2023. We're cutting CO2 emissions by steadily switching to renewable energy sources and reducing labor needs through automation. As a new initiative, we plan to open an eco-friendly zero-emissions warehouse to help realize carbon neutrality. This is intended to achieve the goal of zero CO2 emissions. At the same time, seeing the expanding movement toward CO2 reductions as an opportunity, we're working to secure new customers among companies promoting their own climate change initiatives. We're striving to develop structures for sustained business operations through investments with an eye toward progress in automation technologies. We will seek to minimize the impact of events such as disruptions in logistics networks resulting from natural disasters by securing employee safety, assuring cargo security, and sharing information on delivery conditions with our customers.

We pursue the following initiatives to reduce greenhouse gas emissions and energy consumption and to improve efficiency.

We pursue the following initiatives to reduce greenhouse gas emissions and energy consumption and to improve efficiency.

| Category | Initiatives |

|---|---|

| Mitigation |

[All companies]

[S-Pool, Inc.]

|

| Adaptation |

|

Risk management

The Sustainability Promotion Committee identifies and assesses major climate change risks. In risk management, in addition to gathering and analyzing information on societal developments, market environments to swiftly identify business risks, and other issues, we hold semiannual meetings of the Risk Management Committee to allow swift, appropriate response to risks when they occur. These committees work together to consider measures to prevent and mitigate the effects of potential risks considered to generate large-scale impacts.

Indicators and targets

Our Groupwide GHG emissions reductions targets call for

reducing Scope 1 and Scope 2 emissions by 40% by 2030,

and aims to achieve carbon neutrality in both Scope 1

and Scope 2 emissions by 2050.

* In light of domestic and international trends, the

base year has been revised to the fiscal period ended

November 2021. Reduction targets have been revised

upward.

* The scope of targets is identical to the scope of

calculations of greenhouse gas emissions provided

below.

We have set a target of 100% of electricity consumed in Group business activities from renewable energy by 2030.

As a first step toward these goals, in December 2020,

S-Pool Logistics, Inc. joined the “RE Action—Declaring

100% Renewable” program, introducing renewable energy by

utilizing FIT non-fossil certificates at our main

locations.

Please refer to our ESG data page for actual results and

progress on targets for each indicator.

Participation and support of industry organizations, initiatives, etc.

The S-Pool Group participates in and supports the following industry organizations and initiatives to promote initiatives to address climate change.

In March 2022, we announced our support for the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Future plans call for continuing to incorporate initiatives to address climate change in our business strategies and disclosing information based on TCFD recommendations.

In February 2021, we participated in the Japan Climate Initiative. Through this initiative, we will proactively work to achieve a low-carbon society.

S-Pool Logistics is a participant in RE Action – Declaring 100% Renewable, declaring its intent and taking actions to convert to 100% electricity from renewable energy sources.

We review our participation in and support for industry associations regularly for any major conflicts in thinking between the industry associations and the Company, with consideration for consistency with our business objectives, priority areas, and business activities. We consider withdrawal of our participation and support if any major deviations have been identified.